I get asked this a lot.

"Colleen, if you were so broke for so long, how the heck did you survive in comics? I mean, that's not possible. Because...math."

Well, OK.

I struggled for awhile with whether or not to write about this, but it's actually kind of funny in a horrible way.

I haven't been poor my whole career, but for the majority of my career I was either poor or lower middle class. I was comfortably middle class for a few years in the 1990's, early 2000's, and now.

So I'm OK now. But being very careful with my dough because this industry can bite you in the ass when you least expect it. And I had cancer all last year so, yeah, survived all that without needing a gofundme, that’s like a unicorn for rarity in this busines.

Anyway, for 3/4 of my career I didn't do so well. As in...poor or lower middle class.

How'd I get through it?

Well, a lot of it has to do with The Big Short.

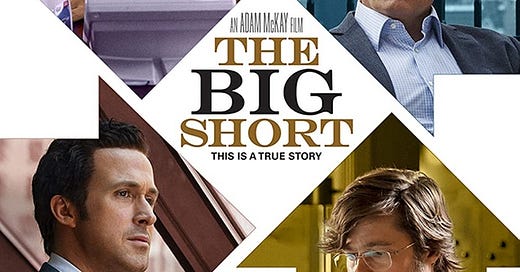

This is one of my all-time favorite movies and one of the best movies ever to explain how the complicated and nutty financial markets work, and why they precipitated a worldwide financial crises in 2008.

It is also the movie that will explain how someone who was as poor as I was rode the poverty train until I was able to get off at a good stop.

In the 1980's, even though I was working on bestselling books, I was not well-treated and got ripped off a lot. The earliest publisher of A DISTANT SOIL paid very poorly, and I was making about $1 per hour. Even adjusted for inflation, that's only about $2.2 per hour in today's money.

So, you know, poor.

My average yearly income for the decade was less than $10,000 per year. Adjusted for inflation again, that's $22,000, but for most of that time I made less than $5000 per year. I made less than about $3000 per year at my first publisher working on a bestselling comic.

Decades later I was making only about $20,000 a year, but I was actually better off in 1989 than I was in 2010.

Anyway, point being, when you're only making about $20,000 per year (adjusted for inflation since 1989) you shouldn't be able to buy a home.

But I bought a home.

I bought a home through a low income loan program that was pretty darned dicey. I didn't know this at the time. The interest rate was also really high - over 9 %.

Sub prime, that's me.

But I figured I would be better off owning a home than renting, and if someone was willing to take a chance on me to let me buy a home, I'd take it. And they let me have it for a 3% down payment.

So not normal.

There were times there where paying that mortgage was digging through the couch for change. I sold original art at rock bottom prices. But I paid the mortgage.

How and why I got that loan is the subject of the film The Big Short. Starting in the 1970's, through a series of complicated legal, and, eventually, really awful financial instruments, low income people got loans they should never have gotten if the loan process were done by the numbers.

The loans were doled out like candy so loan officers could collect juicy commissions without any regard for whether or not the people signing up for those loans had any way to pay them.

Who cared?

Defaults would be covered by banks. By governments.

Hoo boy.

Many, MANY people got into a lot of trouble and defaulted on the loans they should never have taken out in the first place. Financial instruments were bundled together and sold and resold, covering up the low rating of the loans. (I was talking to some other creators who ended up in terrible financial distress from all of this from which they have not recovered. One lost his house. And I'm not telling tales out of school, this was on Twitter.)

All of those dicey loans and the dicey financial instruments - predatory loan schemes, variable interest rates, balloon payments - that financed the housing boom came crashing down like the massive pyramid scheme it was in 2008, and precipitated a worldwide financial crises.

Which is the subject of the film The Big Short.

But in 1989 when I was twenty-something and happy to get a roof over my head, I knew none of this. I did not sign a variable interest rate loan. I did not sign up for balloon payments.

Lucky me.

But I did lock in a payment that I was (barely) able to pay, and I paid it. Without fail. I paid it by not eating very much, and not going on a vacation for a decade. I paid it by doing art jobs I hated. I paid it by working a part time job.

In the early-mid 1990's, there was a comics industry boom. I made good money.

I saved it. Thank God.

In 1995, the industry crashed badly, my income went into the toilet, and I lived on my savings for years.

It was a blessing that I'd bought that house and locked in the mortgage rate, because in no time prices around me skyrocketed, and I was paying less than 1/3 per month what everyone around me was. If I had not bought that home, there was absolutely no way I could have weathered the coming years of financial mess I was in for.

Then once again, I had a brief respite from sucky poverty. For a few years in the early 2000's, I made solid money.

In 2005, near the peak of the housing market, I decided to move out of the city and into a country house with a lot more room, with a cute cottage too that I intended to convert into a studio. I sold my city home for twice what I'd paid for it intending to put the money into renovating the cottage into studio space.

So the dicey loan with the big interest rate returned all my money, interest payments included.

Shortly after I moved in, the cottage I intended to turn into studio space flooded, so I canceled my plans to sink my dough into renovations. That was a blessing, because then I began having debilitating health problems. If I'd put the money into the cottage I would not have had the money from the sale of the house to live on over the years I was sick and untreated.

Eventually, the money ran out, and things looked bleak.

And then things turned around again. And now I'm here.

In short, The Big Short was a disaster for the 6-10 (depends on who you read as a source) million families who lost their homes due to predatory loans and corporate greed. But it was a lucky break for people like me who bought homes they should otherwise have never qualified for, and then sold at the peak of the housing boom.

No way I could have paid for rent in the area where I lived in the late 1990's. Owning a home saved my butt and gave me a stable place to live, and allowed me to reap the rewards of the investment years later. I took care of it, renovated, and it was better when I left it than it was when I got it.

Two years after I sold my home, the value of it tanked. It was worth no more than what I'd paid for it in 1989. Recently, the price has gone back up. The Homeowners Association Fee is ridiculous though: $250 a month! There are resort properties out here that don't charge that much.

So, I was able to squeak by, because I was able to take advantage of a loan program that was originally intended to help poor people, but ended up being twisted into something that hurt them.

I got lucky.

I'm sure many people have told you this, but: if you wrote a memoir I'd buy it!

Thank you for telling these stories. Once upon a time in art school, the few professionals that came to speak to us (or that we attended studio tours of) would say things like "I just applied for [prestigious award/job/opportunity] and got it" or "[Famous person] just called me up and asked if I wanted to work on [amazing opportunity]." I commented to one of my professors that it wasn't very helpful. Stories like yours are what we needed to hear!